"广发银行2021财报"相关数据

更新时间:2024-11-20“We are proud to announce another stellar quarter of quality growth," said Mr. Rui Chen, the chairman of the board and chief executive officer of Bilibili.“During our peak summer season, user growth surged, engagement levels reached an all-time high, and we continued to expand our topline. In the third quarter, MAUs and DAUs each grew 35% year-over-year, advancing us toward our 3-year growth goal. Importantly, our community is stickier and more engaged than ever. Users spent an average of 88 minutes per day on Bilibili, the longest time we have seen in our operating history. Along with our growth, we are deepening our commitment as a responsible public company. We continue to cultivate an inclusive community; promoting positive content and engaging in better environmental, social and governance practices. We hope to instill heartening Chinese culture and values across our community, and bring more‘Created in-China' content to the world" Mr. Sam Fan, chief financial officer of Bilibi, said,“We closed the third quarter with record high revenues of RMB5.2 billion, up 61% year-over-year. Our revenue mix is more balanced and healthier, and we continue to improve monetization across our growing businesses. Motivated by our expansive brand influence, revenues from our advertising business continued to increase, up 110% in the third quarter to RMB1.2 billion, compared with the same period in 2020. MPUs also grew to 24 million in the third quarter, up 59% year-over- year, and our paying ratio reached 8 9%. We believe we are on the right path to achieve our near- and long- term goals, fortified by our strong fundamentals, healthy balance sheet and ample cash reserves of RMB24.4 billion.Total net revenues. Total net revenues were RMB5,206.6 million (USS808.0 million), representing an increase of 61% from the same period of 2020. Mobile games. Revenues from mobile games were RMB1 ,391.7 million (US$216.0 million), representing an increase of 9% from the same period of 2020. Value-added services (VAS). Revenues from VAS were RMB1 ,908 9 million (USS296.3 million), representing an increase of 95% from the same period of 2020, mainly attributable to the Company' s enhanced monetization efforts, led by an increased number of paying users for the Company' s value- added services including the premium membership program, live broadcasting services and other value-added services. Advertising. Revenues from advertising were RMB1,172.0 million (USS181.9 million), representing an increase

of 110% from the same period of 2020. This increase was primarily attributable to further recognition of Bilibili's brand name in China' s online advertising market, as well as Bilibili' s improved advertising efficiency.

哔哩哔哩2021Q3财报Cash and cash equivalents, time deposits and shortterm investments.2021年发布时间:2021-12-15

哔哩哔哩2021Q3财报Cash and cash equivalents, time deposits and shortterm investments.2021年发布时间:2021-12-15 京东2021Q3财报The U.S. dollar (US$) amounts disclosed in this announcement, except for those transaction amounts that were actually setled in U.S. dollars, are presented solely for the convenience of the readers.2021年发布时间:2021-12-10

京东2021Q3财报The U.S. dollar (US$) amounts disclosed in this announcement, except for those transaction amounts that were actually setled in U.S. dollars, are presented solely for the convenience of the readers.2021年发布时间:2021-12-10 eBay2021Q3财报Principles of Consolidation and Basis of Presentation.2021年发布时间:2021-12-10

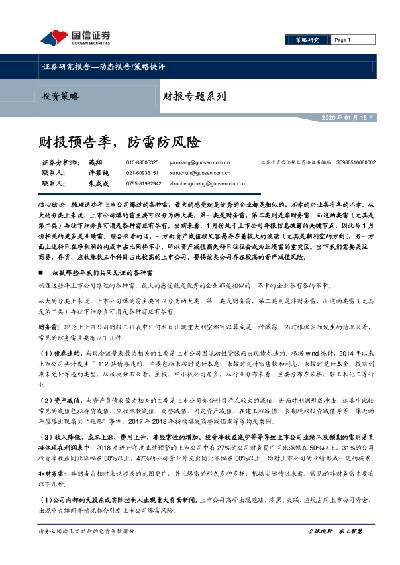

eBay2021Q3财报Principles of Consolidation and Basis of Presentation.2021年发布时间:2021-12-10 财报专题系列:财报预告季,防雷防风险核心结论: 梳理这些年上市公司爆过的各种雷,最大的感受就是优秀的企业都是相似的,不幸的企业各有各的不幸。从大的分类上来说,上市公司爆的雷主要可以分为两大类,第一类是财务雷,第二类则是非财务雷,而这两类雷(尤其是第二类)再往下细分真可谓是各种雷应有尽有。当前来看, 1 月份处于上市公司年报信息披露的关键节点, 因此与 1 月 份相关的更多是业绩雷。 综合来看的话,一方面资产减值损失容易存在着较大的波动(尤其是朝利空的方向),另一方面上述科目在净利润的构成中占比同样不小,所以资产减值损失科目往往会成为业绩雷的重灾区。 当下我们需要关注商誉、存货、应收账款三个科目占比较高的上市公司,警惕该类公司存在较高的资产减值风险。2020年发布时间:2020-05-01

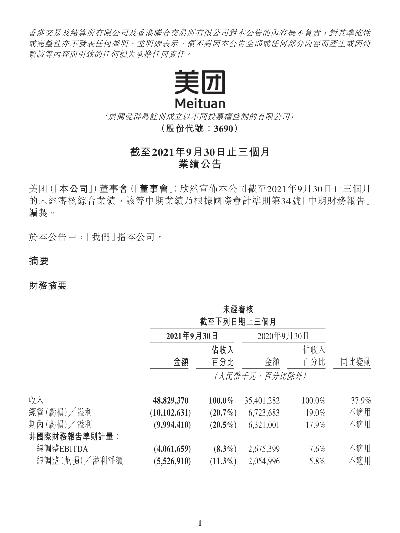

财报专题系列:财报预告季,防雷防风险核心结论: 梳理这些年上市公司爆过的各种雷,最大的感受就是优秀的企业都是相似的,不幸的企业各有各的不幸。从大的分类上来说,上市公司爆的雷主要可以分为两大类,第一类是财务雷,第二类则是非财务雷,而这两类雷(尤其是第二类)再往下细分真可谓是各种雷应有尽有。当前来看, 1 月份处于上市公司年报信息披露的关键节点, 因此与 1 月 份相关的更多是业绩雷。 综合来看的话,一方面资产减值损失容易存在着较大的波动(尤其是朝利空的方向),另一方面上述科目在净利润的构成中占比同样不小,所以资产减值损失科目往往会成为业绩雷的重灾区。 当下我们需要关注商誉、存货、应收账款三个科目占比较高的上市公司,警惕该类公司存在较高的资产减值风险。2020年发布时间:2020-05-01 美团2021Q3财报2021年第三季度,我們的總收入同比增長37.9%,由2020年同期的人民幣354億元增加至人民幣488億元。2021年发布时间:2021-12-10

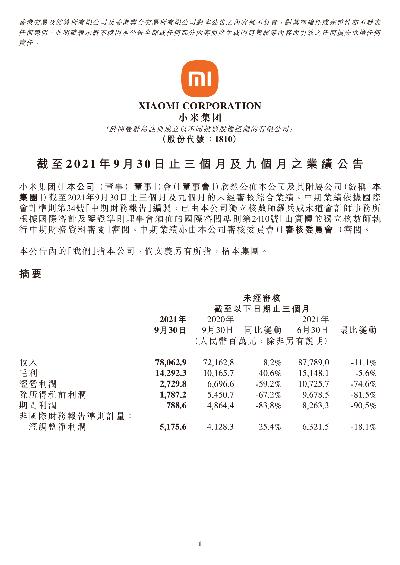

美团2021Q3财报2021年第三季度,我們的總收入同比增長37.9%,由2020年同期的人民幣354億元增加至人民幣488億元。2021年发布时间:2021-12-10 小米2021Q3财报2021年第三季度,小米集团總收入達到人民幣781億元,同比增長8.2%;經調整淨利潤達到人民幣52億元,同比增長25.4%。2021年发布时间:2021-12-10

小米2021Q3财报2021年第三季度,小米集团總收入達到人民幣781億元,同比增長8.2%;經調整淨利潤達到人民幣52億元,同比增長25.4%。2021年发布时间:2021-12-10 拼多多2021Q3财报SHANGHAI, China, Nov. 26, 2021 (GLOBE NEWSWIRE) - Pinduoduo Inc.2021年发布时间:2021-12-08

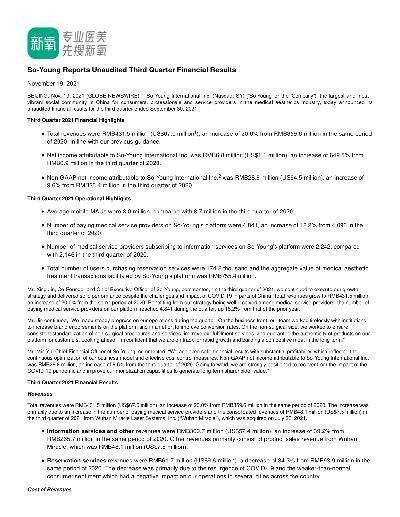

拼多多2021Q3财报SHANGHAI, China, Nov. 26, 2021 (GLOBE NEWSWIRE) - Pinduoduo Inc.2021年发布时间:2021-12-08 新氧2021Q3财报BEIJING, Nov. 19, 2021 (GLOBE NEWSWIRE) - So-Young Intemnational Inc.2021年发布时间:2021-12-10

新氧2021Q3财报BEIJING, Nov. 19, 2021 (GLOBE NEWSWIRE) - So-Young Intemnational Inc.2021年发布时间:2021-12-10 阿里巴巴2021Q3财报中國零售市場-豐富多元的商品供給,引人入勝的用戶體驗,滿足中國消費者的多元化需求。2021年发布时间:2021-12-10

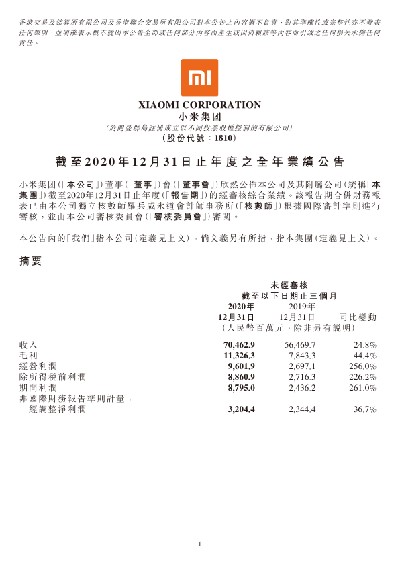

阿里巴巴2021Q3财报中國零售市場-豐富多元的商品供給,引人入勝的用戶體驗,滿足中國消費者的多元化需求。2021年发布时间:2021-12-10 小米2020年财报小米集團(「本公司」)董事(「董事」)會(「董事會」)欣然公佈本公司及其附屬公司(統稱「本集團」)截至2020年12月31日止年度(「報告期」)的經審核綜合業績。該報告期合併財務報表已由本公司獨立核數師羅兵咸永道會計師事務所(「核數師」)根據國際審計準則進行審核,並由本公司審核委員會(「審核委員會」)審閱。本公告內的「我們」指本公司(定義見上文),倘文義另有所指,指本集團(定義見上文)。2020年发布时间:2021-08-27

小米2020年财报小米集團(「本公司」)董事(「董事」)會(「董事會」)欣然公佈本公司及其附屬公司(統稱「本集團」)截至2020年12月31日止年度(「報告期」)的經審核綜合業績。該報告期合併財務報表已由本公司獨立核數師羅兵咸永道會計師事務所(「核數師」)根據國際審計準則進行審核,並由本公司審核委員會(「審核委員會」)審閱。本公告內的「我們」指本公司(定義見上文),倘文義另有所指,指本集團(定義見上文)。2020年发布时间:2021-08-27 2021年Q1腾讯财报董事會欣然宣佈本集團截至二零二一年三月三十一日止三個月的未經審核綜合業績。該等中期業績已經由核數師根據國際審計和核證準則委員會頒佈的國際審閱業務準則第2410號「由實體的獨立核數師審閱中期財務資料」審閱,並經審核委員會審閱。2021年发布时间:2021-07-20

2021年Q1腾讯财报董事會欣然宣佈本集團截至二零二一年三月三十一日止三個月的未經審核綜合業績。該等中期業績已經由核數師根據國際審計和核證準則委員會頒佈的國際審閱業務準則第2410號「由實體的獨立核數師審閱中期財務資料」審閱,並經審核委員會審閱。2021年发布时间:2021-07-20 完美世界2020Q1财报此报告是完美世界2020年第一季度财报。2020年发布时间:2020-05-15

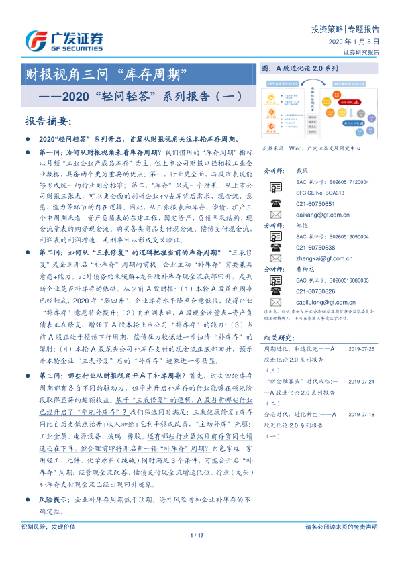

完美世界2020Q1财报此报告是完美世界2020年第一季度财报。2020年发布时间:2020-05-15 2020“轻问轻答”系列报告(一):财报视角三问“库存周期”本文回答了以下三个问题:第一问:为何从财报视角来看库存周期?第二问:如何从“三表修复”的逻辑把握当前的库存周期?第三问:哪些行业从财报视角开启了补库周期?2020年发布时间:2020-07-21

2020“轻问轻答”系列报告(一):财报视角三问“库存周期”本文回答了以下三个问题:第一问:为何从财报视角来看库存周期?第二问:如何从“三表修复”的逻辑把握当前的库存周期?第三问:哪些行业从财报视角开启了补库周期?2020年发布时间:2020-07-21 汽车行业:财报角度分析疫情之下车企抗风险能力疫情对经济影响广泛,汽车行业亦不例外。目前疫情下,汽车行业供需两端收缩,即使部分企业陆续复工,但由于物流运输和人员流动受限及消费信心与购买力不足,短期来看汽车企业或将面临收入下降、成本及债务负担加重、现金流收缩等压力。我们沿用广发宏观报告《如何判别疫情对不同行业的影响?》中的评估方法,结合汽车公司的财务特点对量化指标进行调整,从而评估汽车行业上市公司的抗风险能力。2019-2020年发布时间:2020-07-21

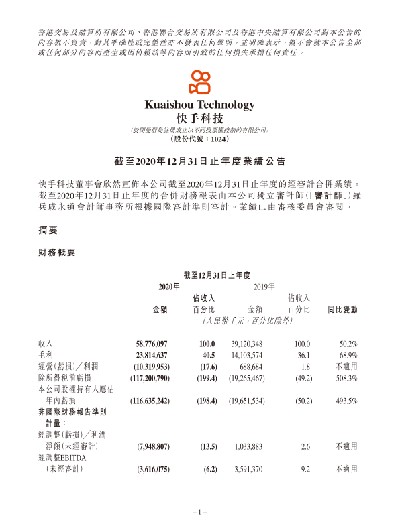

汽车行业:财报角度分析疫情之下车企抗风险能力疫情对经济影响广泛,汽车行业亦不例外。目前疫情下,汽车行业供需两端收缩,即使部分企业陆续复工,但由于物流运输和人员流动受限及消费信心与购买力不足,短期来看汽车企业或将面临收入下降、成本及债务负担加重、现金流收缩等压力。我们沿用广发宏观报告《如何判别疫情对不同行业的影响?》中的评估方法,结合汽车公司的财务特点对量化指标进行调整,从而评估汽车行业上市公司的抗风险能力。2019-2020年发布时间:2020-07-21 快手2020年财报快手科技董事會欣然宣佈本公司截至2020年12月31日止年度的經審計合併業績。截至2020年12月31日止年度的合併財務報表由本公司獨立審計師(「審計師」)羅兵咸永道會計師事務所根據國際審計準則審計。業績已由審核委員會審閱。2020年发布时间:2021-08-27

快手2020年财报快手科技董事會欣然宣佈本公司截至2020年12月31日止年度的經審計合併業績。截至2020年12月31日止年度的合併財務報表由本公司獨立審計師(「審計師」)羅兵咸永道會計師事務所根據國際審計準則審計。業績已由審核委員會審閱。2020年发布时间:2021-08-27 快手2021年Q4及全年财报2021年发布时间:2022-06-10

快手2021年Q4及全年财报2021年发布时间:2022-06-10 2021年年报 全球银行业展望报告2020年,新冠疫情大流行下,全球银行业资产规模逆势扩张,利差收窄,资产质量有所下降,盈利水平下滑,资本水平整体充裕。中国银行业经营态势整体平稳,资负规模稳步扩张,盈利逐步修复,资产质量相对稳定。2021年发布时间:2021-08-30

2021年年报 全球银行业展望报告2020年,新冠疫情大流行下,全球银行业资产规模逆势扩张,利差收窄,资产质量有所下降,盈利水平下滑,资本水平整体充裕。中国银行业经营态势整体平稳,资负规模稳步扩张,盈利逐步修复,资产质量相对稳定。2021年发布时间:2021-08-30 拼多多2021年Q2财报本季度总收入为人民币230.462亿元(135.694亿美元),较2020年同期的人民币121.933亿元增长89%。本季度平均每月活跃用户2为7.385亿,同比增长与2020年同期的5.688亿相比增长了30%。截至2021年6月30日止十二个月期间的活跃买家3为8.499亿,比截至2020年6月30日止十二个月期间的6.832亿增加了24%。本季度营业利润为人民币19.975亿元(3.094亿美元),而2020年同期经营亏损为人民币16.396亿元。本季度非美国通用会计准则第4版营业利润为人民币31.852亿元(4.933亿美元)),而2020年同季度的非美国通用会计准则经营亏损为人民币7.251亿元。本季度归属于普通股股东的净利润为人民币24.146亿元(3.740亿美元),而净亏损为人民币899.3元百万在2020年同一季度。o本季度普通股股东为人民币41.253亿元(6.389亿美元),而2020年同一季度的非美国通用会计准则净亏损为人民币7720万元。2021年发布时间:2021-09-13

拼多多2021年Q2财报本季度总收入为人民币230.462亿元(135.694亿美元),较2020年同期的人民币121.933亿元增长89%。本季度平均每月活跃用户2为7.385亿,同比增长与2020年同期的5.688亿相比增长了30%。截至2021年6月30日止十二个月期间的活跃买家3为8.499亿,比截至2020年6月30日止十二个月期间的6.832亿增加了24%。本季度营业利润为人民币19.975亿元(3.094亿美元),而2020年同期经营亏损为人民币16.396亿元。本季度非美国通用会计准则第4版营业利润为人民币31.852亿元(4.933亿美元)),而2020年同季度的非美国通用会计准则经营亏损为人民币7.251亿元。本季度归属于普通股股东的净利润为人民币24.146亿元(3.740亿美元),而净亏损为人民币899.3元百万在2020年同一季度。o本季度普通股股东为人民币41.253亿元(6.389亿美元),而2020年同一季度的非美国通用会计准则净亏损为人民币7720万元。2021年发布时间:2021-09-13 苹果2021年度财报2021年发布时间:2022-09-09

苹果2021年度财报2021年发布时间:2022-09-09 橙天嘉禾2019年度财报此报告是橙天嘉禾2019年年度财报。2019年发布时间:2020-05-15

橙天嘉禾2019年度财报此报告是橙天嘉禾2019年年度财报。2019年发布时间:2020-05-15